- +91 7208090382

- info@nyaysarthiindiafilings.com

SECTION 8 COMPANY REGISTRATION

- Home /

- SECTION 8 COMPANY REGISTRATION

in just 15,000/- Keynotes on Section 8 Company Registration

Section 8 Company Registration (NGO/NPO) – Nyay Sarthi India Filings

A Section 8 Company is a recognized form of non-profit organization in India, incorporated under the Companies Act, 2013. Much like a trust or society, its principal aim is to promote charitable activities such as education, social welfare, art, culture, science, religion, and other causes that contribute to the overall development and upliftment of society. These companies are established by individuals or groups with a mission—not a motive for profit.

Registered with the Ministry of Corporate Affairs (MCA), a Section 8 company is authorized to operate throughout India for charitable purposes.

At Nyay Sarthi India Filings, we provide end-to-end support for registering Section 8 companies, as well as for setting up other entities like private limited and public limited companies.

Our dedicated team of legal and corporate professionals ensures a streamlined registration process by managing all statutory and procedural requirements efficiently. From document preparation to final approval, we offer expert assistance every step of the way.

Get in touch with Nyay Sarthi India Filings today to learn more about the online registration process, applicable fees, and how we can help you launch your non-profit organization with ease and confidence.

Looking to Establish a Section 8 Company?

Nyay Sarthi India Filings is here to assist you every step of the way. We offer top-notch legal and accounting services to simplify the registration process for your non-profit organization. Our streamlined approach ensures your Section 8 Company is registered within just a few working days—complete with all the necessary documentation and approvals.

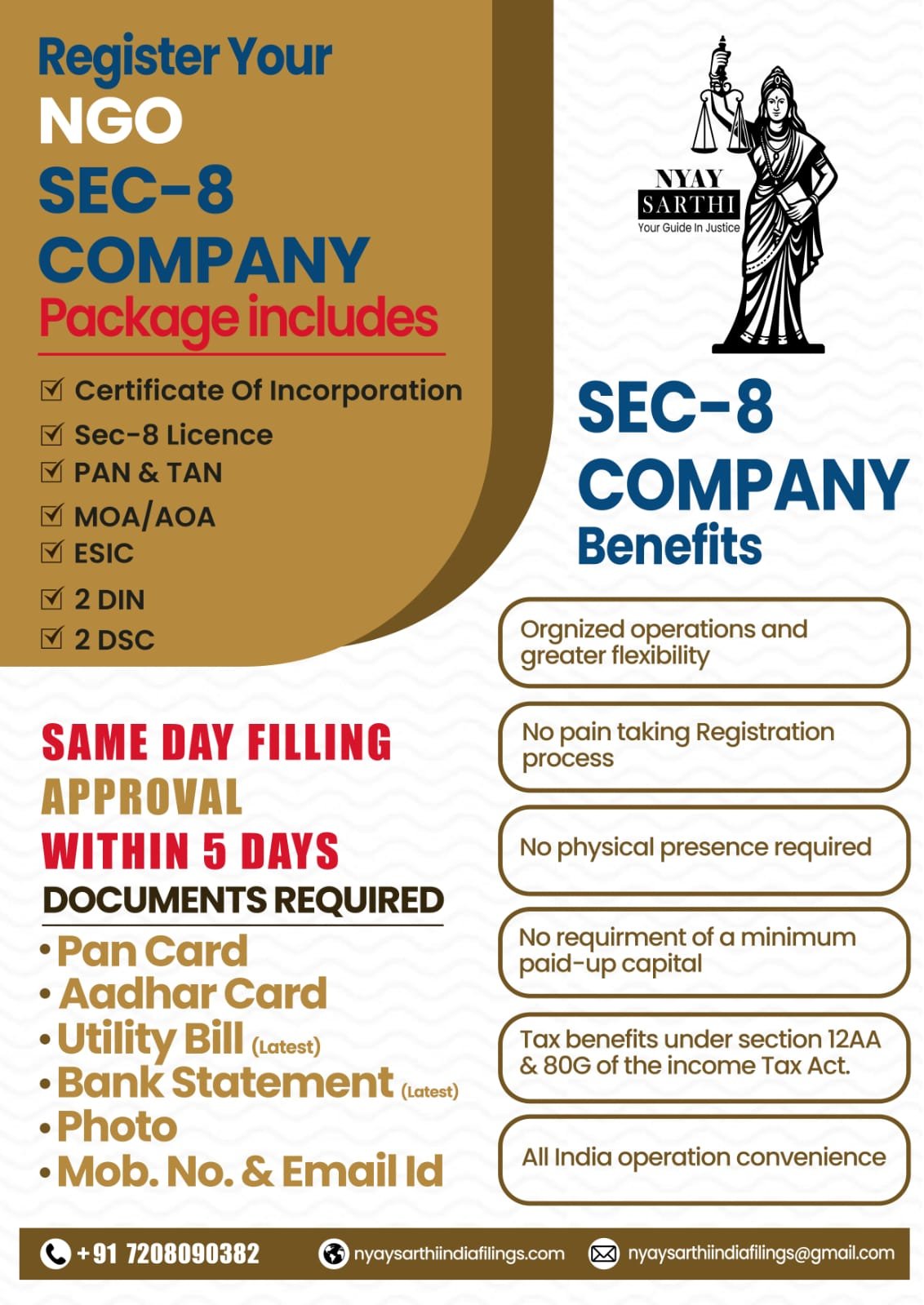

Our Section 8 Company Registration Package Includes:

Company Name Reservation

Digital Signature Certificate (DSC)

Central Government License

Drafting of Articles of Association (AoA) & Memorandum of Association (MoA)

NGO Identification Number

Nationwide Operational Validity

ROC Filing and Government Fees as per the Ministry of Corporate Affairs (MCA)

In addition to Section 8 Company registration, Nyay Sarthi India Filings also supports NGO formation as a Trust under the Indian Trusts Act, 1882, or as a Society under the Societies Registration Act, 1860—offering flexible legal structures tailored to your mission.

Once incorporated, your Section 8 Company can operate across India, backed by legal credibility and nationwide recognition to help you achieve your charitable goals.

Choose Nyay Sarthi India Filings for reliable, efficient, and end-to-end NGO registration services.

Section 8 Company Registration – Step-by-Step Process

Powered by Nyay Sarthi India Filings

A Section 8 Company is a registered non-profit organization in India, committed to promoting social welfare and national development. At Nyay Sarthi India Filings, we simplify the entire registration process to help you legally establish your NGO with ease and confidence.

Step 1: Obtain Digital Signature Certificate (DSC)

The process begins with acquiring a Digital Signature Certificate for all proposed directors. DSC is essential for digitally signing documents submitted to the Ministry of Corporate Affairs (MCA).

Required Details:

Email ID and Mobile Number

PAN Card

Aadhaar Card

Step 2: Apply for Name Approval

Section 8 companies must select a name that reflects their non-profit nature. Names should include terms such as Society, Foundation, Council, Association, Club, Academy, Charities, Federation, Organization, Chamber of Commerce, Institute, or Development.

Step 3: Documentation Preparation

Once the name is approved and DSCs are in place, our team prepares all essential documents, including:

Director and shareholder declarations

Drafted Memorandum of Association (MoA) and Articles of Association (AoA)

Subscription sheets and other supporting forms

Step 4: Apply for Section 8 License (Form INC-12)

We then submit an application to the Regional Director of MCA to obtain the Section 8 License. The authority evaluates your objectives and activities, and typically grants the license within 15 working days.

Step 5: File Incorporation Forms with ROC

After securing the license, incorporation forms are filed with the Registrar of Companies (ROC) through the MCA portal. Once verified, the ROC issues the Certificate of Incorporation along with a Company Identification Number (CIN).

Step 6: Finalize MoA and AoA

Post-approval, we finalize the Memorandum of Association (MoA)—which defines the objectives—and the Articles of Association (AoA)—which outlines the governance rules and internal regulations.

Step 7: Apply for PAN, TAN, and Open a Bank Account

To ensure smooth operations post-incorporation, we assist in applying for the company’s PAN and TAN, and support you in opening a dedicated bank account.

Nyay Sarthi India Filings is your trusted partner in legal compliance and NGO registration. Let us handle the technicalities so you can focus on your mission. Contact us today for a smooth, end-to-end Section 8 Company registration experience.

Why Register an NGO Under Section 8?

Key Benefits of Section 8 Company Registration – Nyay Sarthi India Filings

Registering an NGO or NPO under Section 8 of the Companies Act, 2013 offers numerous advantages, making it one of the most credible and efficient legal structures for charitable organizations in India. Here’s why you should consider it:

Section 8 Companies enjoy multiple tax exemptions under the Income Tax Act. Additionally, once registered under Section 12A and 80G, they can offer tax deductions to donors, encouraging more contributions.

Unlike private limited companies, there is no mandatory minimum capital required to incorporate a Section 8 Company. The company can be formed with any amount of capital, based on operational needs.

A Section 8 Company is a separate legal entity from its members. It can own property, enter into contracts, and sue or be sued in its own name, offering a structured and professional image.

One of the financial advantages is that stamp duty is not applicable on the MoA and AoA, which is otherwise required for private limited or public limited companies—making it more cost-effective.

If the organization obtains 80G certification, all donations made to the NGO become eligible for tax exemption, encouraging more individuals and corporations to support your cause.

Section 8 Companies are considered more credible than other forms of NGOs like trusts or societies. This is due to their strict regulatory compliance under the Companies Act, including mandatory annual audits, ensuring greater transparency and accountability.

Nyay Sarthi India Filings helps you unlock these benefits with our expert guidance and hassle-free registration services. Choose the structure that brings trust, compliance, and long-term sustainability to your non-profit mission.

Eligibility Criteria for Section 8 Company Registration

Guided by Nyay Sarthi India Filings

To establish a Section 8 Company under the Companies Act, 2013, certain legal and operational criteria must be met. Below are the key eligibility requirements:

A minimum of two individuals is required to act as directors or shareholders. These individuals must fulfill all statutory compliance norms applicable for incorporation.

Individuals, limited companies, and Hindu Undivided Families (HUFs) are all eligible to apply for Section 8 company registration.

The primary objective of the company must be non-profit in nature, aimed at promoting:

Social welfare

Education

Sports

Advancement of art and science

Financial assistance to economically weaker sections

At least one director must be a resident of India (i.e., having stayed in India for at least 182 days during the preceding financial year). Legal entities and organizations can also be members of a Section 8 company.

Founders, members, and directors are not permitted to receive any form of salary or compensation, whether in cash or kind, from the company.

Any surplus or profits generated must be strictly reinvested to further the company’s objectives. Profit distribution to members or directors is strictly prohibited.

The company must present a clear project roadmap and defined objectives for the next three years at the time of registration.

At Nyay Sarthi India Filings, we help you navigate these eligibility criteria with ease—ensuring that your Section 8 Company is formed lawfully and efficiently, so you can focus on creating lasting social impact.

PAN Card

Votar ID

Passport ID

Driving License

Bank Statement

Electricity / Mobile bill / Electricity bill / Gas bill

Passport Size Photo

No Objection Certificate from the owner

Utility Bills

Receipt of House Tax

Rent Agreement

Proof of Registry

The services provided by NYAYSARTHIINIDIAFILINGS, are intended to assist clients in the preparation, drafting, and filing of documents related to Non-Governmental Organizations (NGOs), private companies, and other legal entities. Nyaysarthiindiafilings strives to ensure the accuracy and compliance of all documents prepared; however, we are not responsible for errors, omissions, or delays caused by incomplete or inaccurate information provided by clients or changes in applicable laws and regulations. Clients are advised to consult with qualified legal professionals for specific legal advice tailored to their circumstances.

By engaging our services, you acknowledge that NYAYSARTHIINIDIAFILINGS, is not liable for any direct, indirect, incidental, or consequential damages arising from the use of our services or reliance on the documents prepared. All filings and submissions are subject to review and approval by the relevant authorities, and we do not guarantee the outcome of any application or registration process.

©2025 Copyright - Nyay sarthi india filings . - All Right Reserved