ITR 2023-24 FILLING

Keynotes on 2,000/- ITR 2023-24 FILLING

₹2,000 Special Offer!

📢 File Your ITR with NYAY SARTHI INDIA FILINGS! 📢🛑 Stop delaying your tax filing!

⚠ Avoid penalties & last-minute rush. 💵💰

Expert ITR filing with 100% accuracy

✅ Maximize deductions, minimize tax liability

✅ Timely submission before deadlines ⏳

💼 Focus on your work – Let us handle taxes!

📞 Call Now: +91 7208090382 for stress-free ITR filing

🏆 Why NYAY SARTHI INDIA FILINGS?

✔ End-to-end tax support

✔ Document verification & error-free filing

✔ Dedicated CA assistance

“File Now & Stay Compliant!”

What is ITR?

Income Tax Returns (ITR) Simplified by NYAY SARTHI INDIA FILINGS

An ITR is a mandatory financial declaration submitted to the tax department, detailing your income and tax liabilities. This document ensures tax compliance and financial transparency for individuals and entities.

NYAY SARTHI INDIA FILINGS assists in filing the appropriate ITR form (1 through 7) based on your income sources, amount, and taxpayer category (individuals, HUFs, companies etc.), ensuring timely submission before deadlines.

Who Can File ITR

Income Tax Return (ITR) Filing Requirements with NYAY SARTHI INDIA FILINGS

Filing ITR is mandatory for various entities:

Individuals:

Salaried employees exceeding taxable income

Self-employed professionals/business owners

Senior citizens (recommended for financial benefits)

Entities:

Hindu Undivided Families (HUFs)

All companies (profit/loss)

Partnership firms (registered/unregistered)

Trusts/societies with taxable income

NRIs with Indian income

AOPs/BOIs above threshold

NYAY SARTHI INDIA FILINGS ensures proper ITR filing for all categories.

Why Filing ITR is Important

Key Benefits of ITR Filing with NYAY SARTHI INDIA FILINGS

Beyond legal compliance, ITR filing offers crucial advantages:

✔ Loan Approvals – Serves as valid income proof for banks

✔ Tax Refunds – Enables claim of excess tax deductions

✔ Loss Management – Permits carrying forward business losses

NYAY SARTHI INDIA FILINGS ensures you maximize these benefits through proper filing.

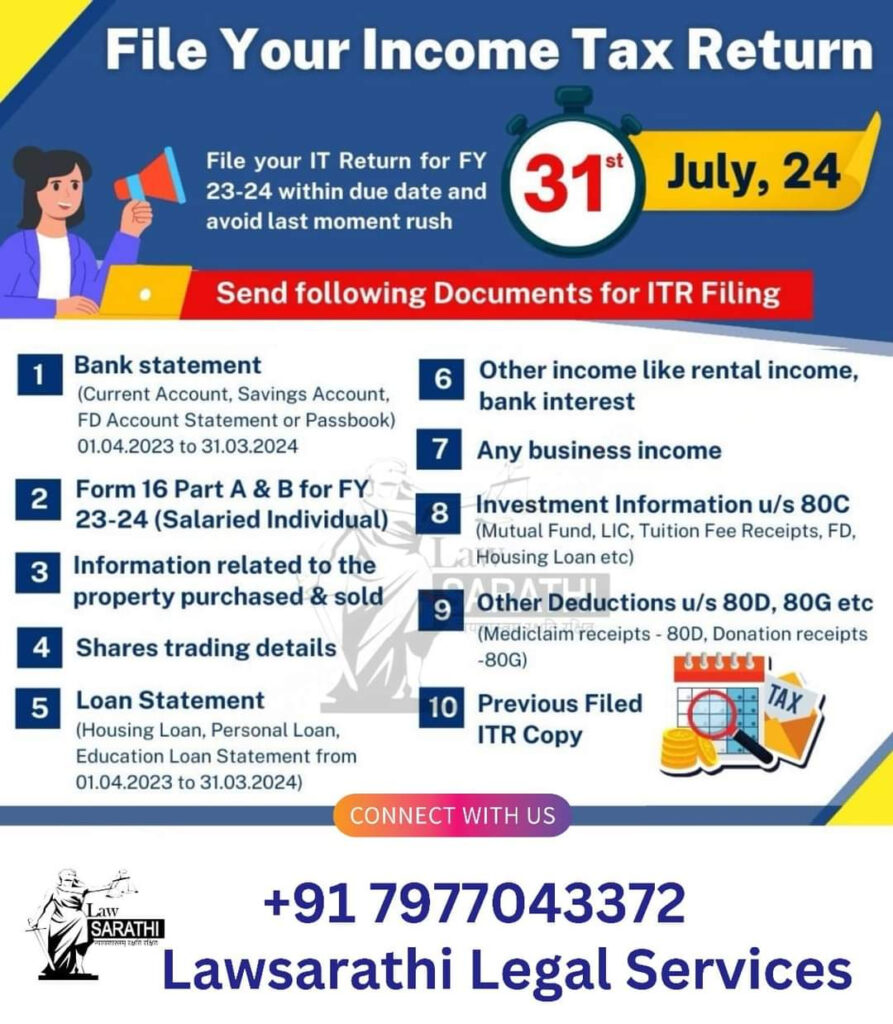

Documents Needed for Filing Income Tax Return (ITR)

Essential Documents for ITR Filing with NYAY SARTHI INDIA FILINGS

Prepare these documents for smooth ITR filing:

Personal Documents:

PAN Card (mandatory)

Aadhaar Card (recommended for linkage)

Income Proof:

Salary slips + Form 16 (salaried)

Form 16A (non-salary TDS)

Bank statements (interest income)

P&L statements (self-employed)

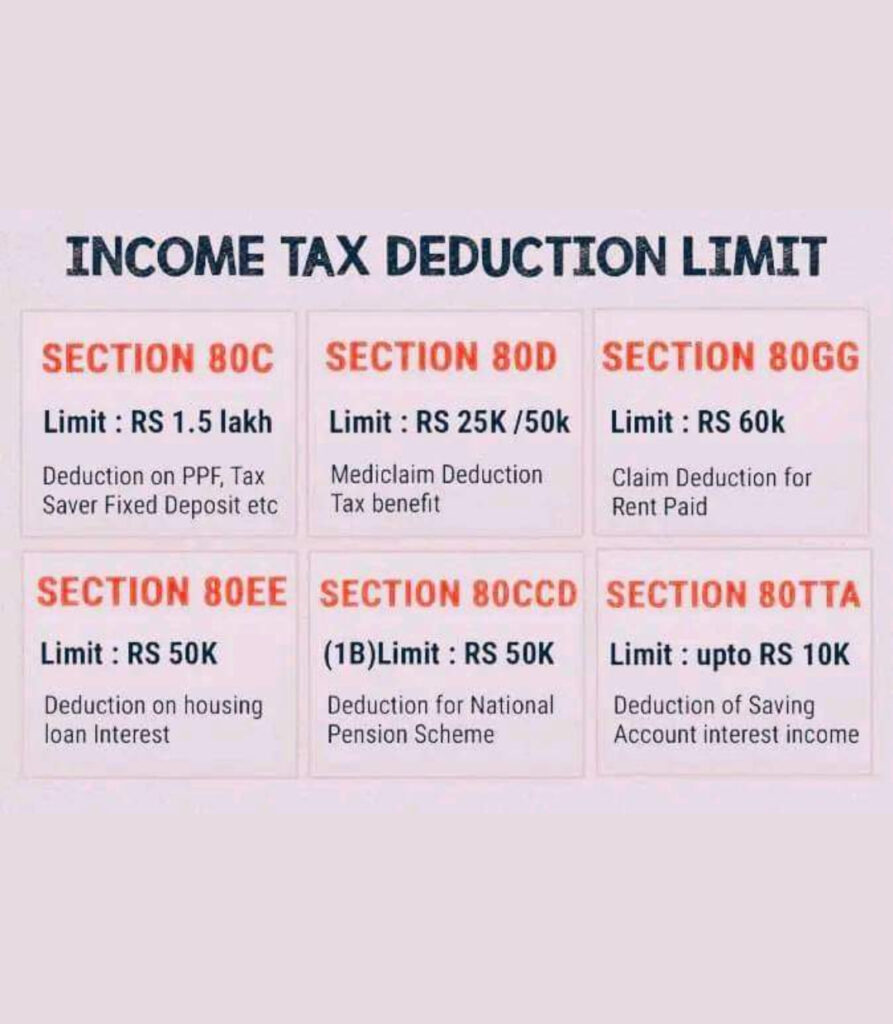

Investment Proofs:

Section 80C/D investments (PPF, insurance etc.)

Home loan interest certificates

Rent receipts (for HRA claims)

Additional Documents:

Capital gains statements

Previous year’s ITR copy

Form 26AS (tax credit statement)

Interest certificates (FDs/savings)

NYAY SARTHI INDIA FILINGS ensures proper documentation for accurate filing.